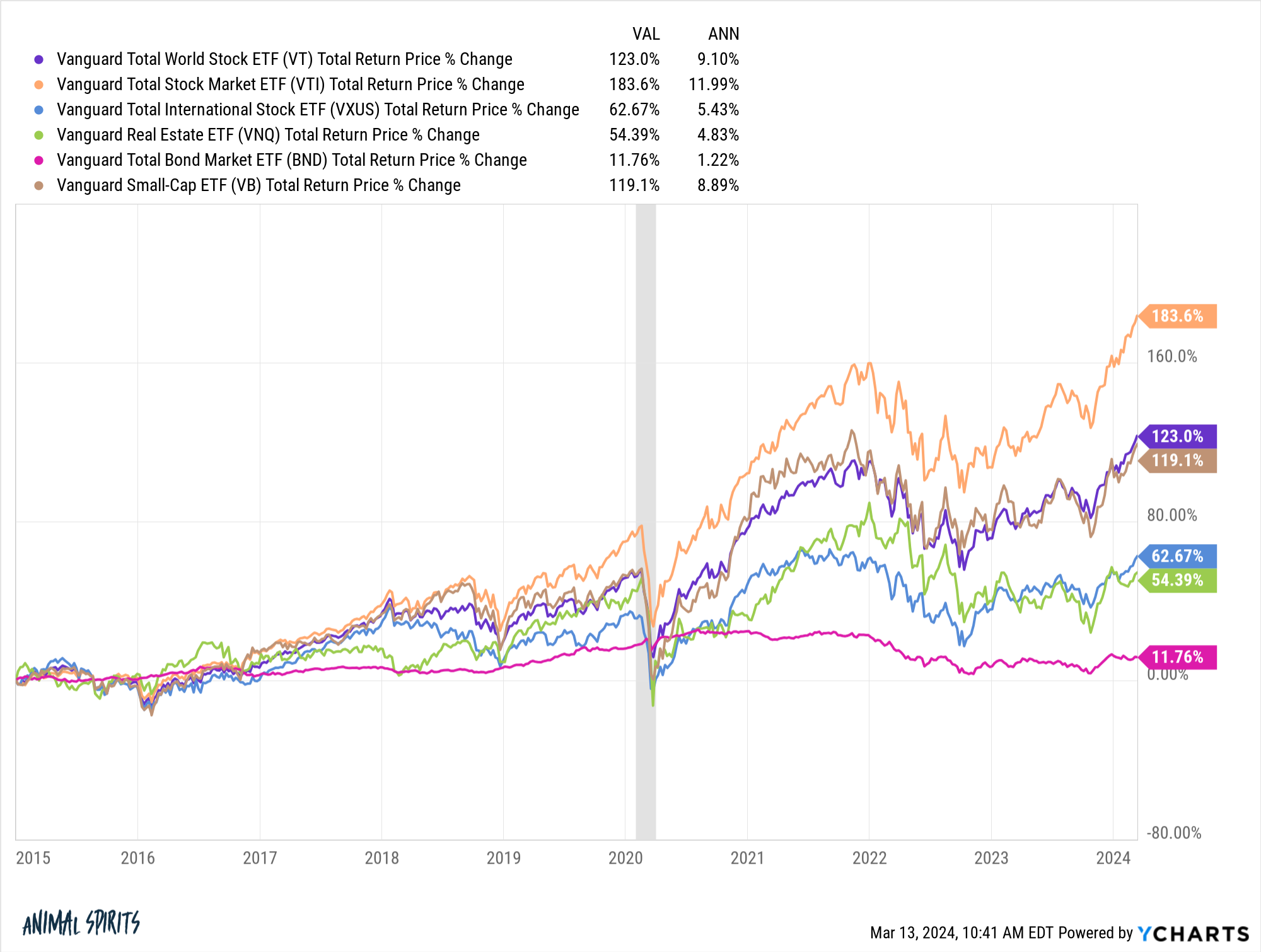

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Related Posts

Recent Post

- Salice Rose

- Indeed Jobs Hartford Wi

- Christchurch Mosque Shooting

- 2023 Fantasy Rookie Draft

- Who Is The Guy On The Progressive Commercials

- Espn Week 1 Fantasy Rankings

- Db Militaria

- Www Dhr Gov Alabama

- Isw Maps Ukraine

- News 5 Wcyb

- Bonnie And Clyde Conroe Tx

- Colonial Heights Non Emergency

- 3 Cent Stamp

- Yahoo Fantasy Pros

- Is Sirius Free Right Now

Trending Keywords

Recent Search

- Lifeway Com

- Cvs Health Employee Handbook

- Pick Up Package From Fedex Facility

- What Happened To Lisa Gonzales Kcra

- Ok Court Records On Demand

- Terrace Park Funeral Home Obituaries

- Usps Pay Scale

- Shed Moving Machine

- Spalding County Sheriff Office

- Nikki Heuskes Age

- Noaa Flagstaff Weather

- Madden 23 My Career

- Fedexoffice

- Entry Level Insurance Sales Agent Bankers Life

- Crate And Barrel Christmas Glasses

_14.jpg)